Real Results

How Our Clients Legally Reduce Their Tax Bill by 5-6 Figures

If you're making over $500K, there's a high chance you're losing 5-6 figures to the IRS—and most CPAs won't tell you. We help high-income earners legally and ethically take control of their tax strategy.

Most CPAs focus on tax compliance—we focus on results. Our clients don’t just get tax returns filed; they get a custom tax strategy that helps them keep more of what they earn every single year.

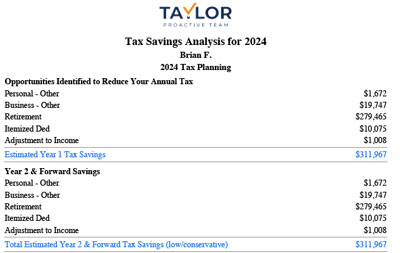

Case Study #1: Business Owner

- Client Profile: Brian F., Business Owner

- The Problem: High tax liability with no structured tax strategy

- The Solution: Implemented advanced retirement contributions, business deductions, and income adjustments to optimize tax efficiency

The Result

- $311,967 saved in Year 1

- Projected $2,014,667 in tax savings over 10 years

- 182% return on investment

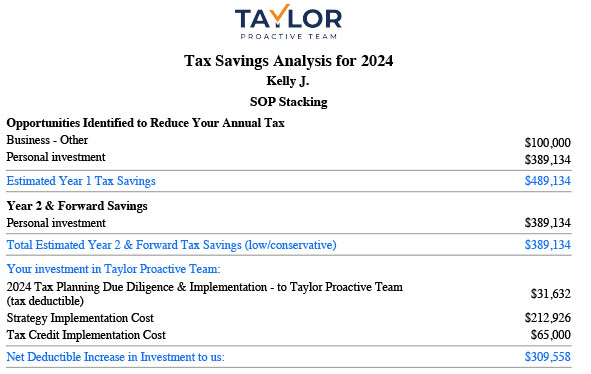

Case Study #2: Real Estate Investor

- Client Profile: Kelly J., Real Estate Investor

- The Problem: Paying excessive taxes on rental income with no structured plan

- The Solution: Implemented SOP Stacking and leveraged strategic personal investments

The Result

- $489,134 tax savings in Year 1

- Projected $1,765,448 in tax savings over 10 years

- 58% return on investment

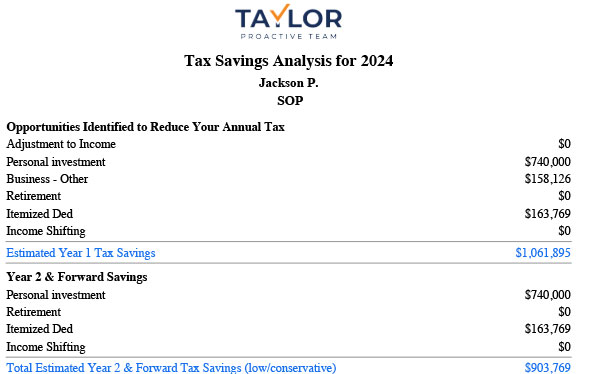

Case Study #3: Executive

- Client Profile: Jackson P., High-Income Executive

- The Problem: No tax strategy, overpaying on earnings

- The Solution: Implemented LAD, SOP, and STTC strategies for tax-efficient wealth management

The Result

- $1,061,895 tax savings in Year 1

- Projected $4,020,314 tax savings over 10 years

- 62% return on investment

Brian F. | View

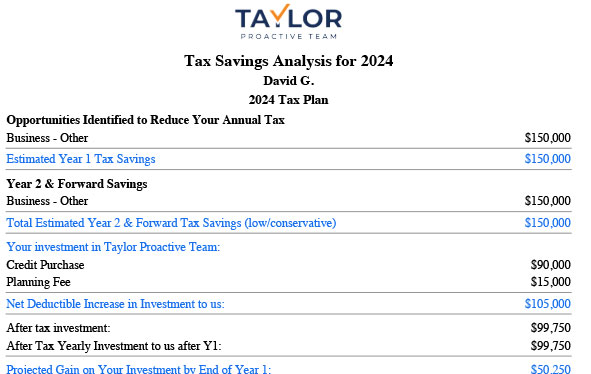

Brian F. | View David G. | View

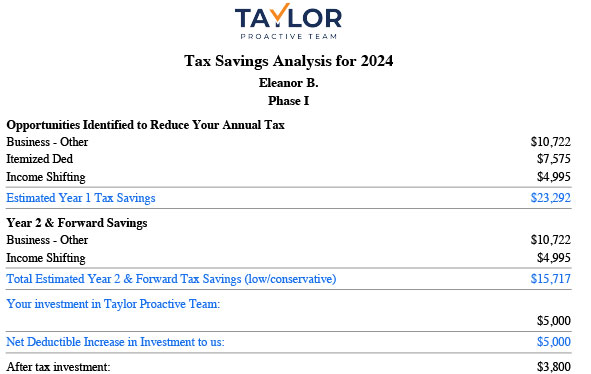

David G. | View Eleanor B. | View

Eleanor B. | View Kelly J. | View

Kelly J. | View Jackson P. | View

Jackson P. | View Jerry & Claire F. | View

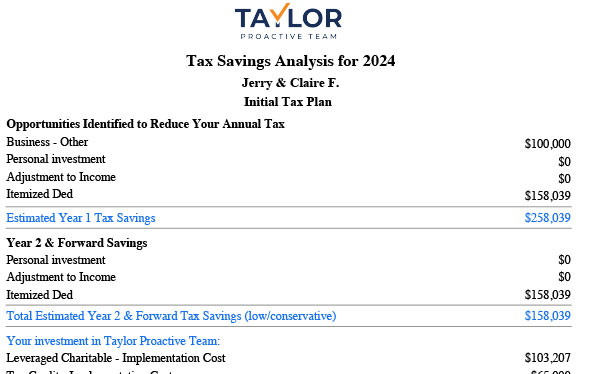

Jerry & Claire F. | View